Dealer Group Consolidation: Not So Fast…

- Nov 7, 2022

- 1 min read

Updated: Nov 13, 2022

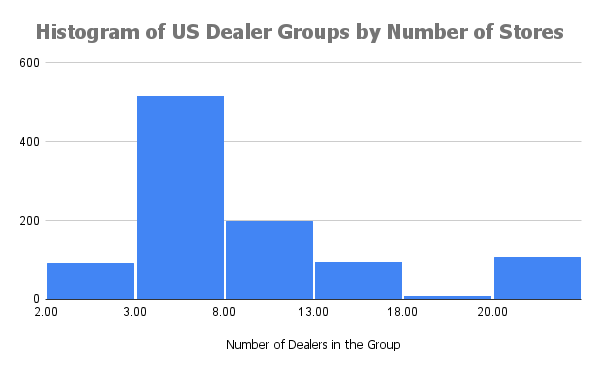

Automotive Market Data is building a large dealer group mapping product (140 groups and growing) to help our customers understand which dealers are part of dealer groups.

Dealer groups are actively buying new stores and consolidation is real. What surprised me in our data was the volume of selling by large groups–I had no idea! Several groups show slow net growth because they’re selling stores nearly as fast as they’re buying. I just assumed consolidation was a one-way street toward bigger.

Several market dynamics can drive disposals of stores, including:

Brand market concentration: OEMs might not allow shared ownership of stores that are near each other or conflict with brand framework agreements.

Store market performance: A store location or team might not meet dealer group standards for a brand or market per vehicle profit or sales volume.

Investment portfolio fit: Some groups align to specific OEM brands based on the group’s long term view of franchise value or dealer relations with a manufacturer.

Inter-group trades: Like in pro sports, occasionally group owners will see strategic value in offering a sale to get access to a location viewed as especially attractive to fill out a group roster or bolster a market area.

Used inventory: With sophisticated national used vehicle market pricing arbitrage and group online used branding bigger now than ever, a store’s location and ability to support used vehicle volume plays into ROI.

Forced Consolidation: Some brands like Cadillac shrank their dealer footprint in the US, and we see aggressive initiatives abroad.

What other reasons prompt groups to sell stores?

Comments